Short Calendar Spread - The typical calendar spread trade involves the sale of an option (either a call or put). A short calendar spread with calls is created by. How does the short calendar spread work, and what are the potential benefits and risks? This strategy can be used with both calls and puts. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. There are two types of calendar spreads: A short calendar spread with calls is an options. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. Selling an option contract you don’t yet own creates a “short” position.

Calendar Spread Options Trading Strategy In Python

A short calendar spread with calls is an options. The typical calendar spread trade involves the sale of an option (either a call or put). A short calendar spread with calls is created by. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. To.

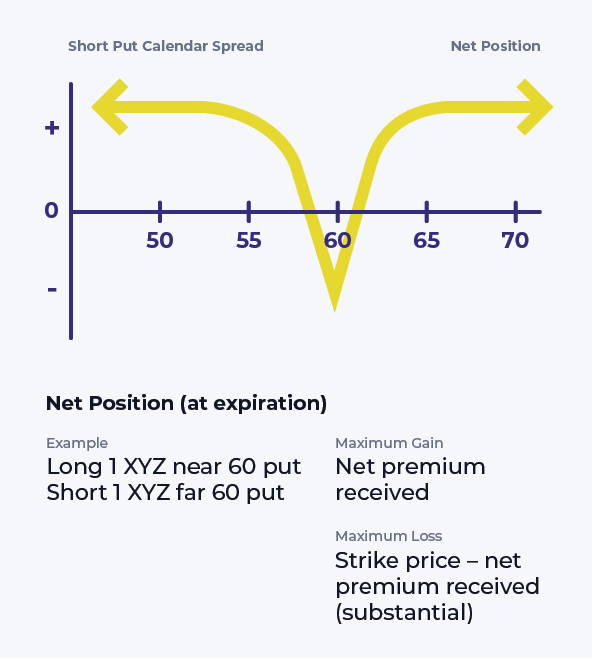

Short Put Calendar Spread Options Strategy

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. How does the short calendar spread work, and what are the potential benefits and risks? The typical calendar spread trade involves the sale of an option (either a call or put). A.

Short Put Calendar Spread Printable Calendars AT A GLANCE

A short calendar spread with calls is created by. How does the short calendar spread work, and what are the potential benefits and risks? A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. Learn how to use a short calendar call.

What Is A Calendar Spread Option Strategy Mab Millicent

A short calendar spread with calls is created by. There are two types of calendar spreads: How does the short calendar spread work, and what are the potential benefits and risks? Selling an option contract you don’t yet own creates a “short” position. Learn how to use a short calendar call spread to profit from a volatile market when you.

Short Calendar Put Spread Staci Elladine

There are two types of calendar spreads: The typical calendar spread trade involves the sale of an option (either a call or put). Selling an option contract you don’t yet own creates a “short” position. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement..

PPT Trading Strategies Involving Options PowerPoint Presentation, free download ID4213867

A short calendar spread with calls is an options. Selling an option contract you don’t yet own creates a “short” position. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. To profit from a large stock price move away from the strike price of.

Short Calendar Spread Printable Word Searches

This strategy can be used with both calls and puts. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position. There are two types of calendar spreads: To profit from a large stock.

Calendar Spreads Option Trading Strategies Beginner's Guide to the Stock Market Module 28

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. The typical calendar spread trade involves the sale of an option (either a call or put). A calendar spread is an options strategy that involves buying and selling options on the same underlying security with.

Calendar Spreads 101 Everything You Need To Know

Selling an option contract you don’t yet own creates a “short” position. There are two types of calendar spreads: To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Learn how to use a short calendar call spread to profit from a.

Calendar Call Spread Option Strategy Heida Kristan

A short calendar spread with calls is an options. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. A short calendar spread with calls is created by. To profit from a large stock price move away from the strike price of.

This strategy can be used with both calls and puts. Selling an option contract you don’t yet own creates a “short” position. How does the short calendar spread work, and what are the potential benefits and risks? There are two types of calendar spreads: A short calendar spread with calls is created by. The typical calendar spread trade involves the sale of an option (either a call or put). A short calendar spread with calls is an options. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

A Short Calendar Spread With Calls Is An Options.

A short calendar spread with calls is created by. How does the short calendar spread work, and what are the potential benefits and risks? A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. The typical calendar spread trade involves the sale of an option (either a call or put).

Selling An Option Contract You Don’t Yet Own Creates A “Short” Position.

This strategy can be used with both calls and puts. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. There are two types of calendar spreads: Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.